On the Glassdoor profile of Taiwan Semiconductor Manufacturing Company, or TSMC—the world’s biggest manufacturer of semiconductor chips—current and former U.S. employees swap messages about grueling working conditions. “People… slept in the office for a month straight,” an engineer wrote in August. “Twelve-hour days are standard, weekend shifts are common. I cannot stress… how brutal the work-life balance is here.” “TSMC is about obedience [and is] not ready for America,” another engineer wrote in January.

More from Fortune: 5 side hustles where you may earn over $20,000 per year—all while working from home Looking to make extra cash? This CD has a 5.15% APY right now Buying a house? Here’s how much to save This is how much money you need to earn annually to comfortably buy a $600,000 home

TSMC’s U.S. operations have earned a 27% approval rating on Glassdoor from 91 reviews—meaning that less than a third of its reviewers would encourage others to work there. Intel, one of TSMC’s main rivals, has an 85% approval rating, albeit from tens of thousands more reviews.

Complaints like these are common on Glassdoor, where anonymity gives workers cover to dish on past and current employers. But the gripes from TSMC workers point to a bigger problem: The Taiwanese chip giant’s tough culture is grating on U.S. employees and job candidates, complicating TSMC’s efforts to hire enough employees to staff its two new Arizona foundries. Those foundries, in turn, are a cornerstone of the U.S.’s $52 billion CHIPS Act aimed at re-shoring the crucial semiconductor industry.

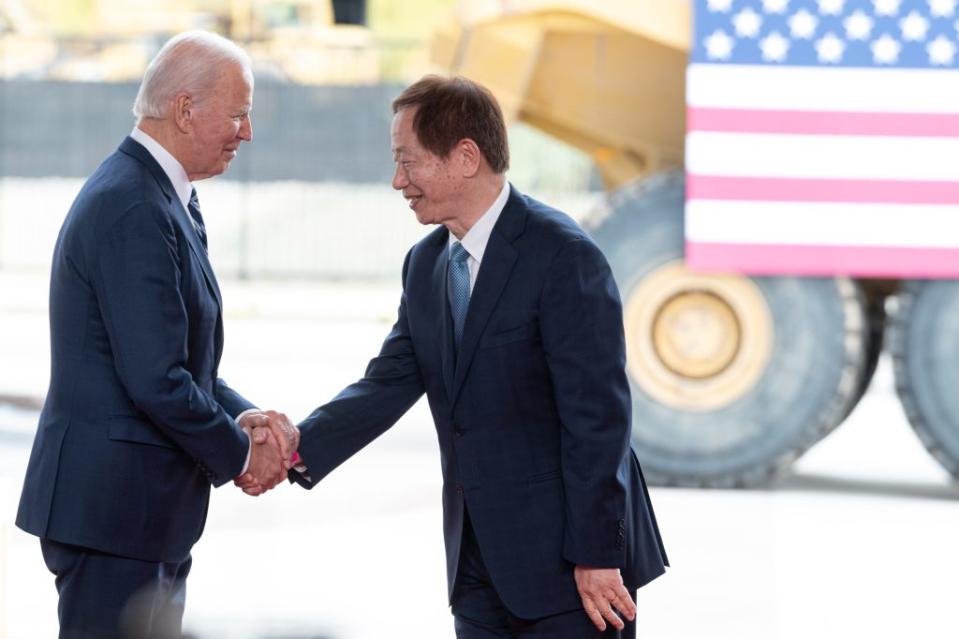

TSMC plans to spend $40 billion to build two semiconductor foundries that will churn out the world’s leading-edge chips by 2024 and 2026. President Joe Biden deemed TSMC’s investment—one of the largest ever in the U.S. by a foreign company—a “game changer” that will shift critical chip supply chains back to the U.S. amid Washington’s high-stakes, high-tech chips arms race with China.

The Semiconductor Industry Association, a trade group that lobbied for the CHIPS Act, estimates the initiative will add 42,000 new jobs by 2030, a figure the Biden administration often cites. TSMC says it will hire 4,500 new workers to support its two Arizona fabs, a sizable chunk of the total new jobs created.

But the company’s hiring ambitions have clashed with a U.S. semiconductor industry whose in-demand workers are accustomed to working with accommodating, well-paying employers and have bristled at TSMC’s tack.

TSMC, which employs 65,000 workers worldwide, says it has on-boarded nearly 2,000 staff for its Arizona plants so far, including 600 engineers. But interviews with recruiters indicate those were hard-fought hires since TSMC’s harsh working culture, rigid standards, and months-long overseas training requirement are turning off current and prospective American employees. The chip giant says its Arizona hiring is on schedule, but it has introduced new policies of late that suggest it’s trying to combat a reputation as an unsparing employer among the engineers and technicians it urgently needs.

TSMC’s rigid expectations for new recruits

In Taiwan, TSMC is revered as “our guardian, savior, and light,” says Chou Kuo-Hua, an accounting professor at Taiwan’s National Pingtung University and semiconductor industry expert. The company, which earned $75.9 billion in revenue last year, manufactures 90% of the world’s most advanced chips that power high-tech devices. TSMC accounts for 5.7% of Taiwan’s GDP and is so essential to the global economy that Taipei and its allies consider TSMC a “silicon shield” that deters China from invading the self-governing island that Beijing claims as its own.

At home, TSMC sets a high bar for its employees. Sixty percent of its Taiwanese employees—and over 80% of its managers—hold a master’s degree or higher, according to a 2020 company report. And the company expects employees to know their place.

“Sure, TSMC might allow a reasonable expression of opinion [on work-related matters]—but only from an engineer or deputy manager to the department manager,” Joey, who has worked as a 5-nanometer chip engineer for TSMC in Taiwan for nearly six years, told Fortune. “It’s impossible for managers to express their opinions to upper-level management. This simply cannot be done,” Joey said. (He asked to be identified only by his nickname due to fear of reprisals.)

Supervisors chastise workers who apply for overtime, Joey said. Most workers accrue overtime to finish their heavy workloads, but many are too afraid to ask to be paid for it. “It’s all a ruse,” Joey said. Fortune contacted several new, U.S.-based recruits and Taiwan-based engineers, but they all declined to talk, citing TSMC’s strict privacy policies and concerns about retaliation.

“Our salary is only [for] 10 hours [a day], [but] we don’t leave until we’re done. And we’ve never been willing to report it,” a member of a private 85,000-person Facebook group for current and former employees of TSMC in Taiwan wrote in February.

TSMC’s worldwide turnover rate among staff that joined in the previous year surged to 17.6% in 2021 from 11.6% in 2017, according to the company’s 2021 sustainability report.

Still, TSMC is a coveted employer in Taiwan, in large part because it offers relatively high wages. New engineering grads with a master’s degree earn on average $65,700 a year, while general full-time staff earn $32,800—compared to Taiwan’s average annual income of $21,700.

Chou credits TSMC’s “highly disciplined” work culture that delineates a “clear hierarchy between supervisors and subordinates” for its dominance. From 2021 to 2022, the chipmaker’s sales skyrocketed, and its revenue surged nearly 30%, reflecting the supercharged demand for chips during the pandemic.

But TSMC’s supremacy in pumping out high-tech chips isn’t making up for the lopsided bargain it’s offering highly-educated candidates in the U.S.: a rigid workplace with arduous training requirements in exchange for pay that’s lower than rivals’.

TSMC ‘doesn’t need all Ph.D.s’

Taiwan’s higher education system, where 31% of university students choose STEM majors—compared to 17.5% in the U.S.—has spoiled TSMC. For jobs in its fabs, the company prefers candidates with Ph.D.s and master’s degrees more so than peers like Intel, says Dylan Patel, a semiconductor industry expert and author of the newsletter SemiAnalysis. Earlier this year, job listings for engineering roles reviewed by Fortune sought candidates with a Ph.D. or master’s degree.

Some industry observers argue that TSMC’s education expectations are unnecessarily high, especially in the U.S., where decades of offshoring chip manufacturing and the lure of Silicon Valley’s high-paying software jobs have created a shortfall of hardware-focused STEM graduates. Consultancy Accenture argues that the U.S. is facing an “acute talent shortage across the entire value chain.” It estimates that the U.S. needs 70,000 to 90,000 “highly-skilled personnel” to fulfill domestic demand for critical semiconductor applications alone, in sectors like aerospace, defense, and automotives.

High-volume fabs demand some highly-skilled workers, like engineers who research and develop technology to manufacture advanced chips. But the bulk of fab employees work on the production line and don’t need more than a bachelor’s degree, says Santosh Kurinec, a fellow and professor of engineering at the Rochester Institute of Technology.

“Ph.D.s are necessary in the industry, but it doesn’t need all Ph.D.s,” she says.

Another challenge is compensation. TSMC pays up to $160,000 annually “for Ph.D.s with some good experience,” says an Arizona-based CEO of a semiconductor recruitment firm hiring for TSMC. That same Ph.D. can earn some $30,000 more at Intel, according to Payscale, a website that tracks company salaries.

TSMC’s American rivals, meanwhile, are defending against its recruiting onslaught. The recruitment firm CEO says candidates have gotten “counter-offers like we’ve never seen. Intel is… giving [people] $10,000 to $20,000 to stick around. We’ve lost people that way.”

Anyone who’s talented and experienced is “highly sought after and making a lot of money. The challenge has been finding folks at Intel [and] GlobalFoundries to make a move without breaking the bank at the same time,” the CEO says.

Up to 18 months of overseas training

Adding to the recruiting challenge is TSMC’s demand that new U.S.-based engineering and technician hires ship off to Taiwan for months of training and cultural exposure.

Since April 2021, TSMC has sent 600 newly hired U.S. engineers to Taiwan. “They are now returning to Arizona armed with…the most advanced semiconductor technology knowledge,” a company spokesperson told Fortune.

The overseas training component, which requires U.S. staff to spend anywhere from 12 to 18 months in Taiwan, is uncommon among its rivals in the U.S., even foreign-headquartered firms, says Justin Kinsey, president of SBT Industries, a boutique semiconductor recruitment firm.

Hiring the first batch of engineers and technicians to train in Taiwan was a “heck of a recruiting challenge,” says the Arizona-based CEO. “We’d send 30 jobs [to 30 qualified candidates] and get maybe one or two people to bite,” he said. Recruiters say that some younger engineers viewed TSMC’s overseas training as an all-expenses-paid trip to Taiwan to train on the world’s most sophisticated chipmaking tools. But many candidates were unwilling to go to Taiwan because of the strain it would impose on their families. Some worried about catching COVID-19 and the territory’s geopolitical tensions with China, while others simply didn’t have passports.

A corporate trainer who works with TSMC on its home turf says the company’s new U.S. trainees are clashing with the company’s veteran staff once they land in Taiwan, mostly because Americans don’t revere authority as much as their Taiwanese colleagues expect them to. Still, she credits TSMC for trying to “bridge the cultural gap.”

TSMC strives to nurture ‘a well-balanced life’

TSMC is making changes to better compete in the cutthroat battle for U.S. chip talent.

The company increased staff salaries worldwide by 20% in 2021 in hopes of improving hiring and retention. (Recruiters say TSMC rivals have hiked their salaries in return, boosting pay across the industry.)

TSMC says it encourages employees to “nurture… a well-balanced life,” with its U.S. facilities offering fitness and health centers, a “variety of activities and clubs, and a warm ambience,” a spokesperson said. The chipmaker also “facilitate[s] several internal communication channels to allow employees to share ideas and concerns regarding work conditions,” the spokesperson said. “We actively listen and provide change where needed.”

The company is also upgrading and expanding its Arizona training facilities so fewer recruits are required to train overseas, but there will “still be some roles which necessitate training onsite in Taiwan,” the spokesperson said.

Still, to attract the large numbers of skilled workers it needs, TSMC needs to focus on “develop[ing] a culture [where] people want to work… and stay,” says a Midwest-based recruiter who soon will start hiring for TSMC. “Even Intel, an American company with all the benefits, compensation, and years of hiring expertise, will still have difficulties [hiring]. I can’t imagine how much harder it’s going to be for TSMC.”

TSMC founder Morris Chang, the man credited with establishing Taiwan’s semiconductor industry, has repeatedly said that the company’s success in Taiwan would be difficult to replicate in another country. The U.S.’s “lack of manufacturing talents”—as Chang put it—and its expensive production costs make TSMC’s U.S. gambit particularly challenging. (Chip costs in Arizona are 50% higher than in Taiwan, and Chang recently warned they could double.) In Chou’s view, TSMC’s decision to expand U.S. production is “not economically rational,” but the plan’s geopolitical value—to the U.S. and to Taiwan, in the event of any conflict with China—may make it too important to fail.

This story was originally featured on Fortune.com

More from Fortune:

5 side hustles where you may earn over $20,000 per year—all while working from home

Looking to make extra cash? This CD has a 5.15% APY right now

Buying a house? Here’s how much to save

This is how much money you need to earn annually to comfortably buy a $600,000 home

Follow Us on Google News