UK official data showed average private rents rose last month at the fastest pace since comparable records began in 2015.

Figures from the Office for National Statistics (ONS) show that the soaring costs faced by renters have not slowed down since 2022.

The economy grew 9% in the 12 months to February, according to preliminary estimates, up from an 8.5% annual rate in January.

Average UK house prices fell 0.6% to £282,000 in the 12 months to January, the Office for National Statistics said, noting that the pace of decline had slowed.

Latest Currency: UK inflation slows more than expected, markets react

Recent industry data suggests that price growth will resume as mortgage rates fall in anticipation of a Bank of England rate cut.

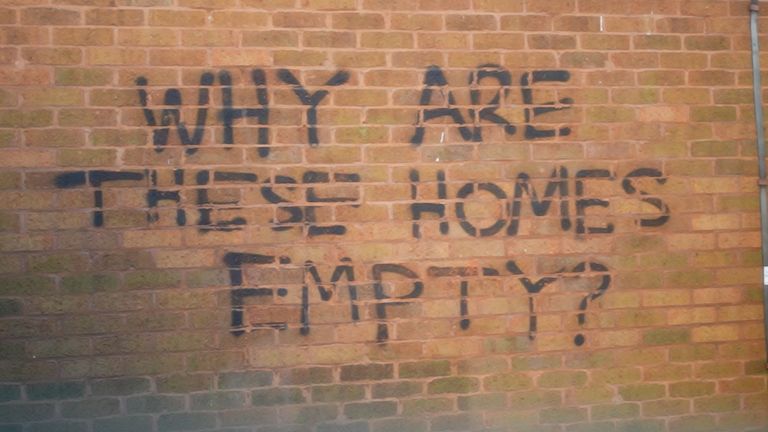

The upward pressure on rents comes from demand far outpacing supply and the higher interest rates landlords face passing on to tenants.

Matt Corder, deputy director for prices at the ONS, said: “Brent has the highest annual rent growth of all regions, Melton has the lowest and Kensington and Chelsea Prices are highest, with rental prices lowest in Dumfries and Galloway.

“Average house prices in the UK continue to fall, although the annual fall is smaller than in recent times.

“Indeed, average house prices in Scotland are rising at their fastest annual rate in more than a year.”

At 9%, rents are rising far faster than inflation.

read more:

The beach town where the rental market is broken

Separate data released by the Office for National Statistics on Wednesday showed overall annual economic growth slowed to 3.4% last month from 4% in January.

However, the prospect of a rate cut by the Bank of England appears to be months away as the data does not allay rate setters’ concerns about future inflationary pressures.

Hannah Bashford, director of Model Financial Solutions, said of the ONS figures: “While these figures are shocking, they are not surprising as we have seen many landlords must not Not raising rent to cover increased interest costs and to meet lenders’ affordability standards.

“The rental market has collapsed and those without mortgages are benefiting from rising prices while others are stuck investing.

“These rents make it almost impossible to save a deposit, so the cycle continues.”

Follow us on Google news ,Twitter , and Join Whatsapp Group of thelocalreport.in