Add thelocalreport.in As A Trusted Source

As 2026 approachesMany people are already worried about household expenses, which appear to be rising month by month.

one Increase energy price caps Means heating bills for millions of people will rise simultaneously The temperature starts to drop sharply. Likewise, stubbornly high inflation – albeit declining by the end of 2025 – has led to continued price increases For many people, this speed is undesirable.

Energy arrears have more than doubled over the past five years, rising to £4.4 billion at the end of June. Meanwhile, recent research by the Trussell Trust found that around 14 million adults are without food because they cannot afford it.

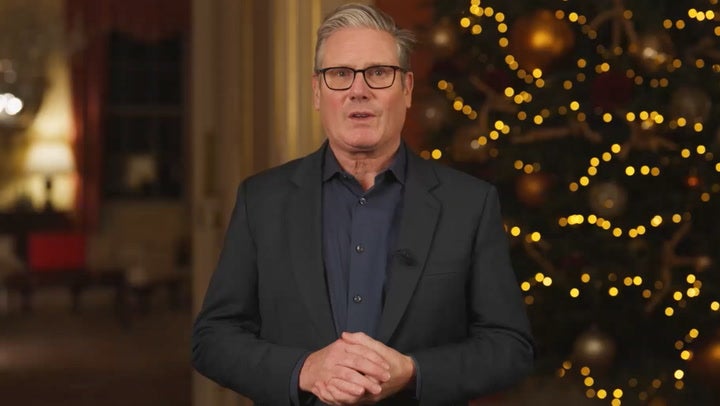

exist his new year speechgentlemen Keir Starmer Vowing to tackle the cost of living, he said the UK would “turn a corner” and start to feel “hope”.

He said: “The challenges we face have been decades in the making and recovery will not happen overnight, but getting our country back on its feet will be our strength.

“Strength means we can provide you with living cost support.”

The Prime Minister pointed out several government designed to reduce cost of living 2026, including freezes on rail fares, prescription fees and fuel taxes.

Here are some other plans government Implemented starting from April this year:

New government support fund

The existing Home Support Fund (HSF) scheme allocated by local councils will be funded by laborNew Crisis and Resilience Fund.

This new program will continue to provide vital assistance to people facing financial hardship, supplementing standard benefits and grants. It will also integrate discretionary housing payments, which are one-time grants for housing costs.

Operates similarly to the current program and is eligible family Across the UK, support will be available for basic appliances, utility donations and more billand a direct cash payment of up to £300.

Local authorities will retain discretion on how to allocate funding to best suit local needs.

The government has pledged £1bn a year to authorities for at least three years towards the change, replacing the previous annual confirmation model.

While council leaders welcomed the long-term commitment, the Local Government Association Tell independent In October, an overwhelming majority (98%) did not believe funding would adequately meet local needs.

Energy bills reduced

family will also see Average energy bill reduced by £150 from April to scrapping the energy efficiency scheme.

Rachel Reeves confirmed in last year’s budget that the Energy Company Obligation (ECO) scheme would end, scrapping its levy on energy bill.

Another reason for the cuts is the transfer of 75% of the cost of subsidies for older renewable energy projects, known as the “renewable energy obligation”, from electricity bills to general tax for the remainder of the spending review period, saving an average of £88.

Ending the ECO scheme will result in a further saving of £59 on average. Combined with the £7 VAT savings from these two measures, the government says this will save the average household £154 on their bill.

Benefits and wages rise—but not for everyone

April 2026 will see Income growth above inflation The standard allowance for all Universal Credit claimants is around 6.2%.

For a single person over the age of 25, this means an increase of £6 per week, from £92 to £98. Couples where one or both partners are over 25 will see their weekly fees increase by £9, from £145 to £154.

Most other benefits, including PIP, DLA, Attendance Allowance, Carers Allowance and ESA, are expected to rise due to inflation in September alone, by 3.8%.

The state pension will also rise by 4.8% from April next year, in line with annual earnings growth, taking the weekly amount to £241.05.

However, at the same time, the monthly payment rate for the health-related part of Universal Credit for new applicants will be cut from £105 to £50. Rates for existing claimants will also be frozen until 2029.

This means a reduction of over £200 per month, effectively halving the additional cost and making it a smart move for anyone who thinks they might be eligible to apply as soon as possible.

Meanwhile, the national living wage for eligible workers aged 21 and over will rise by 4.1% to £12.71 an hour. The government estimates that at this rate, full-time workers would see a £900 increase in their annual gross earnings, benefiting around 2.4 million low-paid workers.

The national minimum wage for 18 to 20-year-olds will also rise by 8.5% to £10.85 an hour, narrowing the gap with the national living wage.

Second-child welfare cap ends

The principal also Announcing the lifting of the cap on second-child benefits Last year’s budget was scrapped after intense pressure from backbenchers, campaign groups and political opponents.

The Office for Budget Responsibility’s (OBR) fiscal outlook calculates that the move will increase benefits for 560,000 households by an average of £5,310.

The government expects the change, which will come into effect in April 2026, to see 450,000 fewer children living in poverty by 2029/30.