Traders Place Bullish Bets on Twilio Stock

Call traders are pummeling Twilio Inc (NYSE:TWLO) amid news that activist investor Legion Partners is urging the cloud computing concern to make board changes and consider divestitures. By the midday mark, more than 50,000 bullish bets have changed hands, which is double the intraday average amount. New positions are opening at the top three most popular contracts, led by the weekly 6/2 68-strike call.

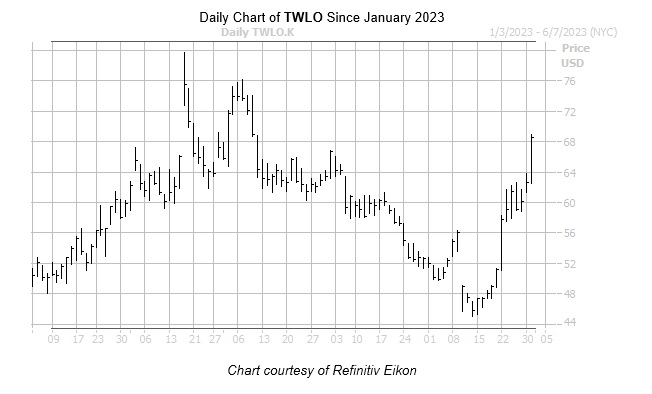

Last seen up 8.1% at $67.77, TWLO is pacing for its ninth daily win in 10 sessions. The equity is trading back above the $67 level for the first time since early March, but remains well below its 2023 high of $79.70. Year-to-date, Twilio stock is up 38.6%.

Leading up to today, calls were already popular. At the International Securities Exchange (ISEE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), TWLO sports a 50-day call/put volume ratio of 2.68 that sits in the 92nd percentile of its annual range.

For those looking to get in on the action, Twilio stock is seeing attractively priced premiums at the moment, per its Schaeffer’s Volatility Index (SVI) of 60%, which sits in the low 11th percentile of its annual range.

Follow Us on Google News