China on Friday imposed tariffs on U.S. imports of an acid widely used in food, feed, pesticides and medical fields, amid heightened bilateral trade tensions with...

Nairobi, Kenya—— Kenya began three days of mourning on Friday after the country’s defense minister and nine other senior military officers were killed in a helicopter...

Washington — The U.S. immigrant population from South and Central Asia has reached new heights over the past decade and continues to grow rapidly. Recent data...

Officials and analysts say Israel’s limited retaliation against Iran provides an opportunity for de-escalation, but the threat of a major conflict will remain as long as...

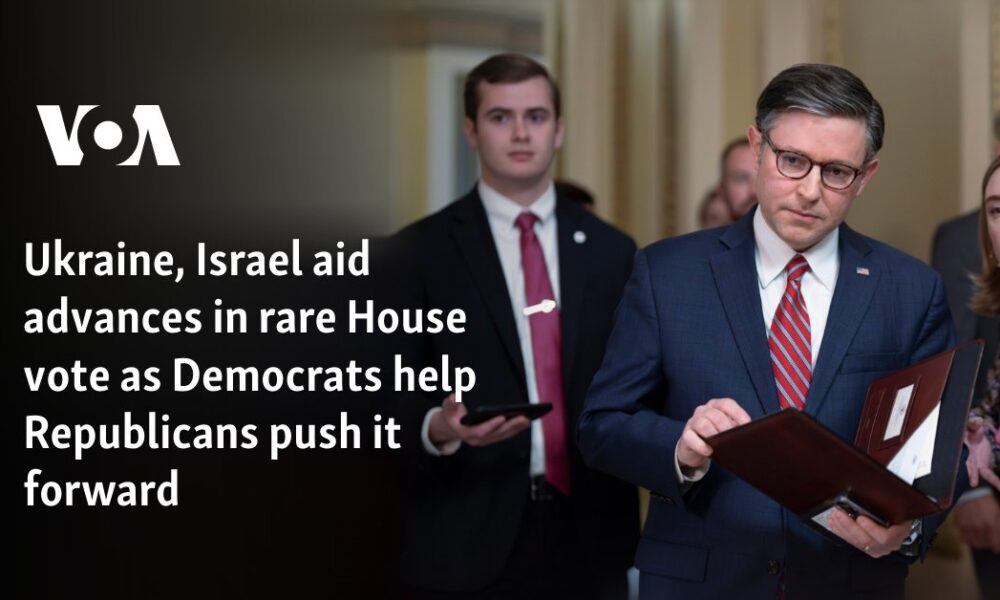

In a rare display of bipartisanship, the House on Friday advanced a $95 billion foreign aid package targeting Ukraine, Israel, Taiwan and humanitarian support, as a...

Florida Governor Ron DeSantis signed a bill requiring public schools to teach communist history from kindergarten through 12th grade. Beginning in the 2026-27 (school year), the...

A man set himself on fire on Friday outside a New York courthouse where Donald Trump’s historic hush money trial was underway, witnesses said. A witness...

“Witnesses saw a man entering carrying a grenade or explosive belt,” the source said. French authorities detained a man on Friday after receiving an alert from...

Islamabad: Pakistan’s Punjab Chief Minister Maryam Nawaz’s convoy allegedly killed a motorcyclist while traveling from Narowal to Kartarpur for the three-day Baisakhi celebrations, Dawn reported ....

Tesla said it was not aware of any crashes or injuries related to the situation. According to a U.S. notice issued this week, Tesla is recalling...