Add thelocalreport.in As A Trusted Source

this Government wants more Britons start invest It’s almost impossible to have a better ad campaign handed to them because FTSE 100 – Index of the largest listed companies london stock exchange – Posted its best annual returns in 2025 since the rebound from the financial crisis.

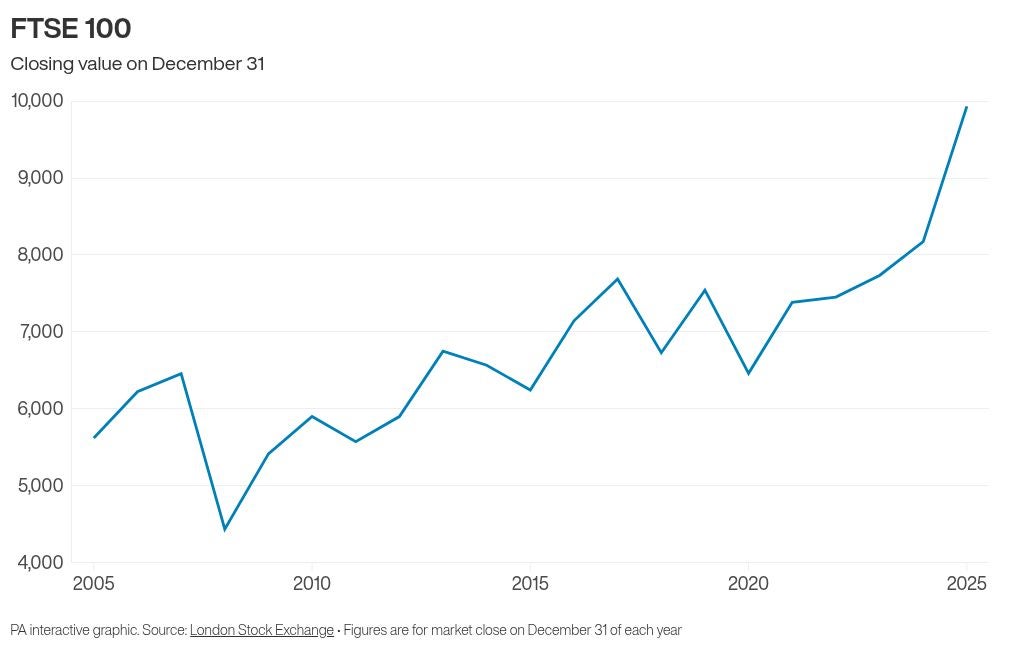

From the last trading day in 2024 to December 31, 2025, the UK’s largest stock market index rose by a total of 1,758.36 points, an increase of 21.5%.

By comparison, the U.S. Stoxx 600 index of Europe’s largest companies rose 16.7%. S&P 500 Index rose 17%, while technology-focused Nasdaq The composite index rose 21% for the year.

Strong growth among UK-listed companies in the FTSE 100 index was particularly notable among many mining companies, defense companies and financial firms.

This comes despite political and economic uncertainty throughout the year, both domestically and globally, including a sharp fall in stock markets due to Trump’s tariff announcements, an oil price shock from Iran’s threat to close the Strait of Hormuz, Rachel Reeves’ delayed budget and concerns about a stalling UK economy.

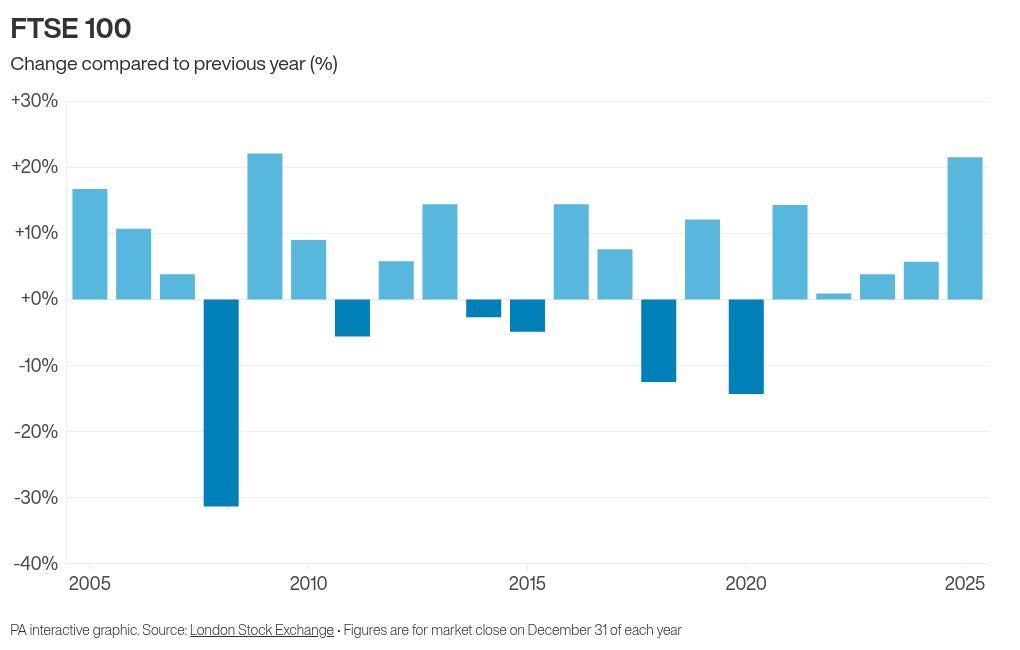

This marks the fifth consecutive year of gains for the FTSE 100, meaning the index has risen in eight of the past ten years, although typically gains are rarely this large, as evidenced by its best year since 2009, when the index rose 22.1% in the wake of the global financial crisis.

The FTSE 100 has risen an average of around 9% over the past decade, which is a much better return on money than a savings account would typically offer, and the difference is significant when interest rates are in a downward cycle, as they are now.

The index closed at 9,931.38 points in 2025, breaking through historical highs several times throughout the year and coming close to breaking through the 10,000-point mark for the first time.

The blue-chip index’s success this year means it has outperformed its European and US peers, including France’s Cac 40 index, while rising roughly in line with Germany’s Dax index.

Receive a free partial share worth up to £100.

Capital is at risk.

Terms and conditions apply.

advertise

Receive a free partial share worth up to £100.

Capital is at risk.

Terms and conditions apply.

advertise

The steady earnings of FTSE-listed companies have attracted investors despite widespread weakness in the UK economy and political uncertainty that has led to sharp swings in global stock markets.

It’s been a particularly strong year for precious metals producer Fresnillo, with its shares soaring about five times from 2025 levels, while gold miner Endeavor Mining’s shares have also risen nearly threefold.

Shares of defense companies Rolls-Royce and Babcock also surged, roughly doubling in value, in a year where geopolitical tensions continued to rise.

Bank stocks also rose on higher profits and business progress, led by gains from Lloyds Banking Group, which nearly doubled on steady gains throughout the year.

The stock market turmoil reached its peak in early April, as investors reacted to U.S. President Donald Trump’s announcement of plans to increase tariffs on U.S. imports from countries around the world. The FTSE 100 suffered its biggest one-day drop since the start of the Covid-19 pandemic, as did Wall Street’s S&P 500 and Dow Jones, but has since pared losses and returned to growth.

Dan Coatsworth, head of markets at AJ Bell, said the FTSE 100 had “just the right ingredients for investors in a year marked by political, trade and market uncertainty”.

“This year’s success in blue-chip indexes is not a flash in the pan,” he added.

“The FTSE 100 has delivered positive returns in eight of the past 10 years, averaging 9.1% per annum including dividends. This performance enhances the appeal of long-term investing.

“There may be a few years when performance disappoints, but history shows it’s worth pursuing.”

Despite the strength of the FTSE 100, a large number of listed companies will choose to abandon the London Stock Exchange by 2025 (london school of economics) used in foreign stock markets or taken into private hands.

Direct Line delisted from the London Stock Exchange after being acquired by rival Aviva in a £3.7 billion deal that formed a major force in the UK insurance market.

Beverage manufacturer Britvic was also acquired by Carlsberg earlier this year, transferring it from the stock market into the hands of the Danish beer giant.

Meanwhile, London markets suffered further setbacks as drugmaker Indivior announced plans to delist from the London Stock Exchange after moving its primary listing to the United States. Nasdaq Last year, British fintech company Wise said it planned to shift its primary listing location from London to New York.

Among high-value acquisitions completed this year, companies including Royal Mail owner International Delivery Services (IDS), Hargreaves Lansdown and industrial group Spectris were taken private.

Nonetheless, 2025 will also be a stronger year for IPO activity, with 11 companies set to list on the London Stock Exchange in 2025, raising a total of £1.9 billion, the highest level since 2021, according to PwC analysis.

Additional report by PA